It’s “COVID times,” and your team is stretched thin—they’re running back and forth to the parking lot, making and receiving countless phone calls each day, and trying to juggle increasing demand for veterinary care — often with more appointment requests than available appointment slots.

2020 has not been easy, but we’re all adapting so we can move forward and succeed. Perhaps, as more pet owners have demanded telemedicine, you’ve implemented services like chat messages and video calls. But, how are you accepting payment for those services? You may be providing contactless care, but are your clients able to pay for that care virtually?

It’s time to embrace contactless payments in your practice.

“Oh no, not something new!” you may be thinking. Don’t worry, millennials have been doing it for years with Venmo, Squarecash, and other digital currency platforms. In fact, you may already be using contactless payments yourself. Have you set up your phone’s wallet, or used Apple Pay or Google Pay at the grocery store? If so, you’re already using one contactless payment method. Let’s take an in-depth look at the contactless payment options for your practice.

6 ways your practice can collect contactless payments

A contactless payment is any method that allows a customer to pay for a merchant’s services without touching their point-of-sale equipment. For example, instead of touching a grimy PIN pad, or a pen pulled out from who knows where, customers can “tap to pay,” although literally, no tapping is required. If you see four curved lines forming a radio signal, the payment device is enabled for contactless payment. Simply wave your payment method (e.g., your debit card) close to the device, and your bank account magically takes a hit.

A contactless payment is any method that allows a customer to pay for a merchant’s services without touching their point-of-sale equipment. For example, instead of touching a grimy PIN pad, or a pen pulled out from who knows where, customers can “tap to pay,” although literally, no tapping is required. If you see four curved lines forming a radio signal, the payment device is enabled for contactless payment. Simply wave your payment method (e.g., your debit card) close to the device, and your bank account magically takes a hit.

While this is the most common contactless payment method many small businesses use, your veterinary practice has more options, including:

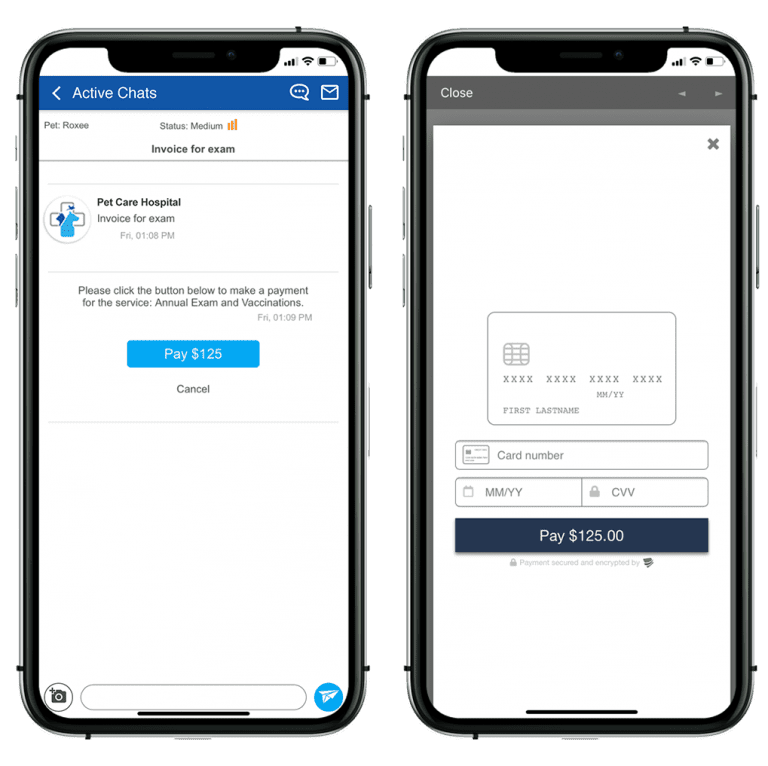

1: Use your customized veterinary practice app

The safest, most efficient method to collect payment is through your own customized practice app. This method is a boon during curbside appointments, and for telemedicine consults with clients at home. Clients also can prepay for prescription refills and food, allowing your team to prepare orders for contactless pickup, reducing phone calls and saving time.

2: Create a “text-to-pay” link

Many platforms, like PayPal, allow you to create your own unique “text-to-pay” link which can easily be sent over email or text. While simple enough, this will require you to check another platform to verify if the payment was successful or declined.

3: Use your practice management software’s integrated payment processing feature

Contactless payment technology enables practices to receive payments from clients who use wireless terminal devices while inside their car. Some clinic software programs offer integrated payment processing to facilitate the use of contactless payment technology, and also enable Apple Pay and Google Pay transactions. Contact your software’s tech support to see if they have integrated payment processing features available, or if they have tips on implementing contactless payments with their software.

4: Encourage clients to use your online pharmacy or store

Another way to reduce phone calls and create more time in your daily schedule is to encourage clients to use your online store or pharmacy. Partner with the major prescription diet manufacturers to allow food shipment straight to clients’ homes. Your clients can also use your online pharmacy, like Vetsource, to order prescription and diet refills shipped to their front door. This not only prevents contact between your clients and your team, but also improves compliance and keeps your clients away from outside online providers.

5: Support contactless RFID and NFC payment options

Contactless payments can be made via certain credit cards, debit cards, key fobs, smart cards, smartphones, and other devices capable of using radio-frequency identification (RFID) or near field communication (NFC). These cards and devices allow payments to be made without any physical contact between your clients, their cards, your payment terminal, and your team. Well-known examples include Apple Pay, Samsung Pay, Google Pay, and Fitbit Pay. Your bank’s mobile application may also support this contactless payment method. In most cases, no PIN entry, signature, or other validation is required, which prevents transmission of viruses and bacteria.

6: Accept credit card numbers over the phone when necessary

The simplest, most obvious — and most time-consuming — way to adapt your current payment process to contactless payment is a good old-fashioned telephone call. Once your patient is ready for discharge, your CSR can contact the client for payment over the phone. Your credit card terminal likely allows a “card not present” payment, and you can enter additional information (e.g., the CVV number on the back of the card) to decrease fraud risk. If your appointment schedule is packed solid, however, you may not wish to add extra time (and extra phone calls) for over-the-phone payments.

Why are contactless payments important for veterinary practices?

With COVID-19 forcing social distancing, people are hesitant to get too close to one another, much less fork over or accept germ-laden cash, checks, or cards. Money can trap pathogens in its fibers, ready to infect the next victim, the same way that pets can act as fomites, and carry virus particles on their fur.

With COVID-19 forcing social distancing, people are hesitant to get too close to one another, much less fork over or accept germ-laden cash, checks, or cards. Money can trap pathogens in its fibers, ready to infect the next victim, the same way that pets can act as fomites, and carry virus particles on their fur.

If your veterinary assistant wears gloves to grab the client’s cash in the parking lot, but then returns inside and hands off the bills to your CSR, who counts out change in the midst of packing up a client’s pest prevention order, you’re not really protecting your clients, or your team. The front door knob has been handled multiple times, that client’s prevention product could be covered in contagious pathogens, and your assistant has now helped catch a runaway dog in the parking lot with those same gloved hands.

Limiting contamination is a struggle—especially during a pandemic—but contactless payments can help your team, and your clients, minimize contact, and remain safe.

How can contactless payments help your team and clients

Numerous scenarios highlight the benefits of contactless payments. Your team members will enjoy these perks:

- No cash, no change — There’s no need to wait around and hold a pet while an owner digs for cash.

- No back and forth — Contactless payments eliminate the back-and-forth with invoices, payments, and signing the credit card slip.

- No client lines — Your clients can check out in the exam room, or directly from their vehicles during curbside appointments.

Contactless payments can also benefit pet owners in a myriad of ways. If you’ve ever experienced the following scenarios in your practice, you know your clients are going to love contactless payment:

- The I-have-no-control — The client losing their purse as they struggle to control their exuberant adolescent Labrador, spilling everything all over the floor.

- The show-off — The cat-lover who insists on walking their leashed feline past all the hungry hounds in the lobby before checking out.

- The suffering — The grieving family barely holding it together as they pay for their beloved pet’s euthanasia and cremation.

- The forgetful — The client who forgot their wallet at home or needs their parent to pay.

Ready to ride the technological wave into the future? Contactless payments are in high demand. Implement these easy-to-use systems to conveniently and efficiently collect payment while protecting your team, your clients, and your community. Visit the Vet2Pet website for more details on this fantastic telemedicine feature—which is especially crucial during COVID times—or schedule your free 30-minute demo to give Virtual Payments a spin, along with a plethora of other customized client engagement features.